Best Personal Finance Money Books 2022

The world of finance can be a very complicated place. For the uninitiated, navigating issues such as investment, return on investment, risk and reward, and even deposits and interest can drive people nuts. As such, you need full education to firmly have a grasp of what is to be expected. Fortunately, the literary circuit has a raft of books ready to help you ease in, written by noted experts in the financial sector. Here are some that are worth the time.

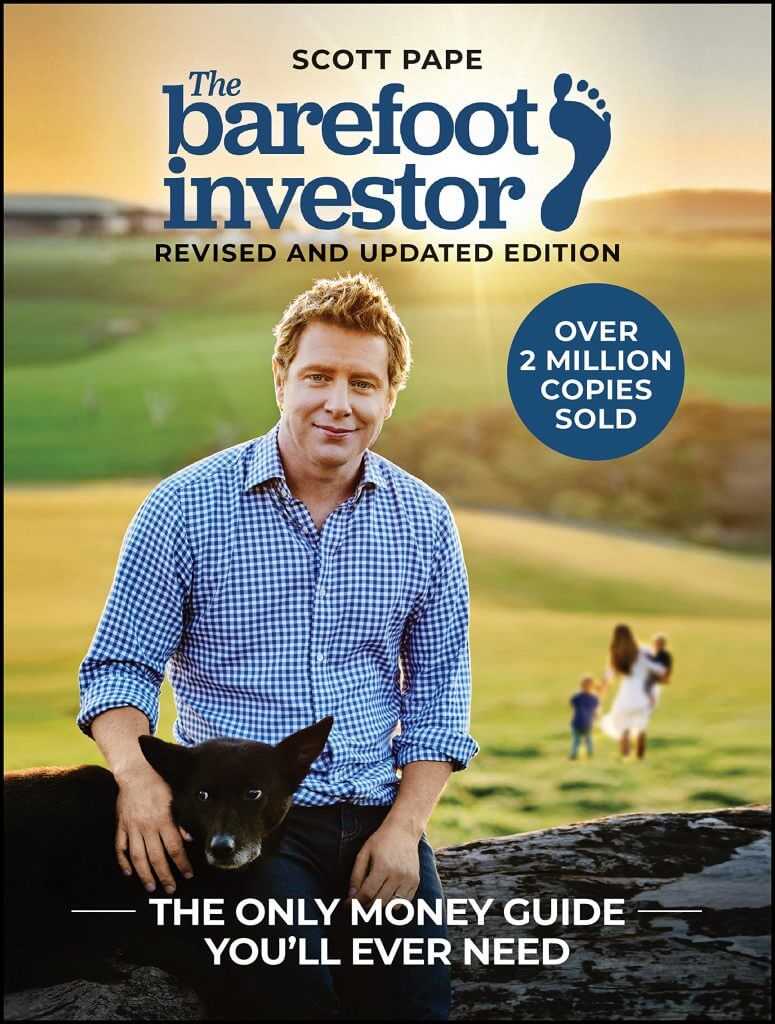

The Barefoot Investor by Scott Pape

One of Australia’s seminal books on finance, Pape’s 2016 sleeper hit drew on his years of financial services experience working with a vast array of people, ranging from AFL and NRL teams, the Federal Government, to elderly pensioners. The book offers stories from various people detailing their experiences in personal finance. Pape also breaks down certain financial strategies into more simple terms. Some readers have noted advice in the book that worked well, such as stop using your credit cards (or destroy them if necessary) then pay the debt, and to spread your money into multiple bank accounts.

Currently logging in at over two million copies sold, Barefoot Investor is continually updated for the current fiscal year.

Pape has parlayed the book’s success into a second book in 2018 called The Barefoot Investor for Families, which delves into family finance matters and teaches parents and children alike with valuable lessons on saving and investing money for the future. He also established a Barefoot Money Movement for students and moved into non-profit financial counselling in 2020, even while managing a counselling programme for people hit hard by the 2019-2020 bushfires.

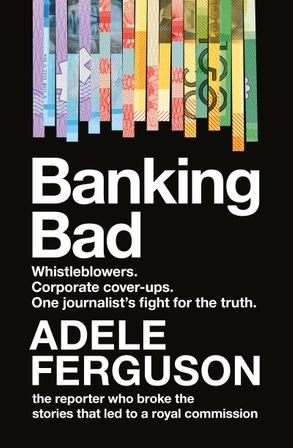

Banking Bad by Adele Ferguson

A play on the hit drama series Breaking Bad, Banking Bad chronicles Australia’s banking and financial services industry in the run-up to the Hayne Royal Commission, via Ferguson’s reporting for Fairfax Media (now part of Nine) dailies SMH, The Age, and the Australian Financial Review, plus Four Corners and 7.30 on ABC. The book details her research on how banks and financial services ran on deceptive practices, toxic work cultures, and customer frustrations since deregulation in the 1980s. Her coverage became pivotal to the establishment of the Hayne Royal Commission in 2017. The book also earned Ferguson the 2020 Davitt Award for True Crime/Non-fiction and a Gold Walkley for the associated work on Four Corners and Fairfax dailies.

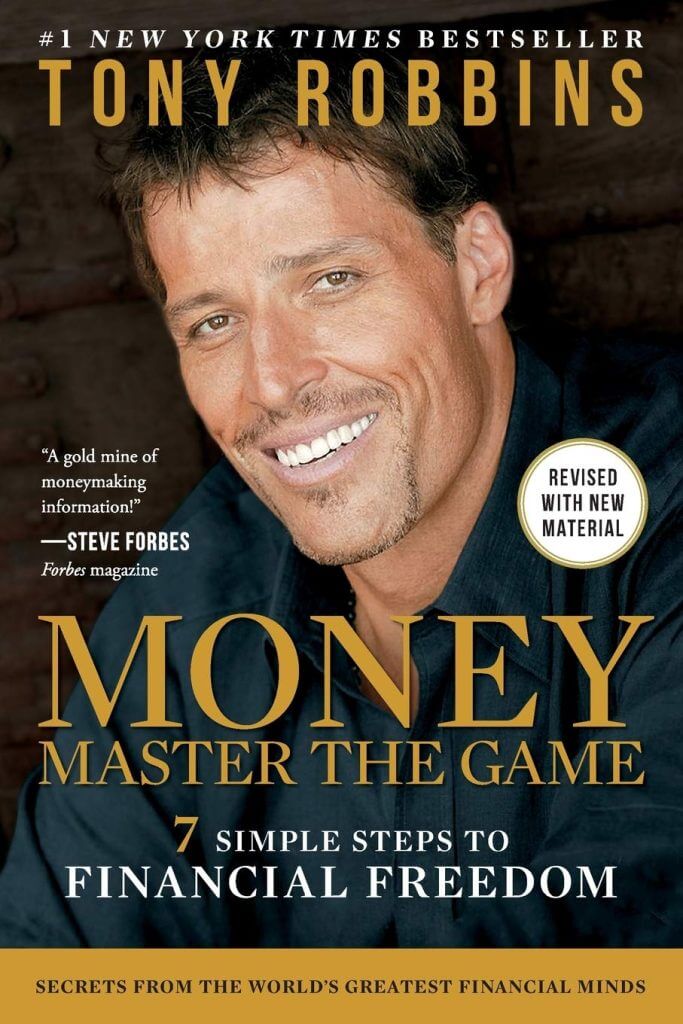

Money: Master The Game by Tony Robbins

Written in 2014, Money: Master The Game contains insights from over 50 financial experts, investors, and business people, collated from ten years of research, including thoughts on the 2008 global financial crisis. Robbins’ discussion with them is worked into a seven-step plan for financial independence. The main objective of the plan is to educate readers into creating their own roadmap for “lifetime income.” Some readers note that the book stresses the importance of defining your financial goals and work to achieve them, plus saving roughly ten percent of your monthly salary.

The Richest Man in Babylon by George S Clason

Published in 1926, The Richest Man in Babylon details various tips on financial management, using the ancient Mesopotamian city of Babylon and its status as a major economic power in the ancient world as a model. Each topic in the book combines modern-day finance tenets with parables from Babylonian culture for added relevance. The main points from the book include making a strong effort to invest in property, save ten percent of earnings, and to keep learning of more money-making opportunities while avoiding get-rich-quick schemes.

Rich Dad, Poor Dad by Robert Kiyosaki, Sharon Lechter

Ask anybody in the finance circuit what books have become critical to their success, and chances are, Kiyosaki and Lechter’s Rich Dad, Poor Dad is at the top of their list. Published in 1997, the book covers various pieces of finance advice framed against stories of Kiyosaki’s life growing up under his father and later the father of his best friend. His biological father is depicted as the “poor dad” who worked hard but never had a degree of financial security and the father of his best friend is the “rich dad” who builds a fortune through business and investments. The book claims that through some careful moves, you don’t need to amass a large income to fully set yourself up for life.

Broke Millennial by Erin Lowry

Erin Lowry’s Broke Millennial is specifically geared towards the younger generation who may be unaware of the mechanics of finance and economics, based on her own life lessons. The book details various steps to apply into your own finance plans, from being almost broke to not worrying about money again. It also tackles the common problems that younger people face when it comes to handling money such as splitting the bill during nights out with friends, paying off student loans, and talks with your partner on managing finances.

I Will Teach You to Be Rich by Ramit Sethi

Published in 2009, Sethi’s I Will Teach You to Be Rich is based on helping people in the 20s to 40s shake off fears of being hamstrung by not having enough money while wanting the best things in life. Central to this is a six-week programme designed to first settle all debts and gradually earn enough money then choose what to invest it on. Some chapters also focus on using bank accounts for automatic payments.

The Millionaire Next Door by Thomas Stanley, William Danko

Released in 1998, The Millionaire Next Door is a product of 20 years’ research and interviews with many millionaires in the US. Instead of being a self-help guide to wealth, the book covers what steps the interviewees did to achieve their financial status and in the process, help break common stereotypes about the rich and moneyed. Insights from the book include finding ways to earn money but live within means, periodic savings, and how to avoid becoming everyone’s money hero.

A little knowledge can go so far, but it pays to learn more by reading a book. Pick them up at your nearest bookshop today.

If you liked our “Best Personal Finance Money Books 2022” and find it useful, check our blogs regularly for more information on how to get out of debt and get updates on personal wealth apps in Australia.