The Best Budgeting Apps to Help Aussies Save Money

What differentiates a good budgeting app to a bad budgeting app? Here are a few of the best budgeting apps to help Aussies save money.

Flexible Budget Categories

Having your transactions categorised helps define income and expenses and essentially are the foundation of your potential budgets. The app that you decide to use should allow you to categorise and sub categorise, or at least allow you to edit your transactions.

Apps that don’t allow you to change categories are ones you want to stay away from as some categories may be irrelevant to your personal life. Having an extremely accurate budget allows for improvement, promptly. Without this the budgeting process becomes a lot harder.

Income and Expense Limits – Adaptable

The budgeting app that you decided to go with should analyse both your income and expenditures and help make changed where needed in order to complete savings goas etc.

Alerts and staying on top of the client’s income and expenses in extremely important in the service they are providing being a budgeting app.

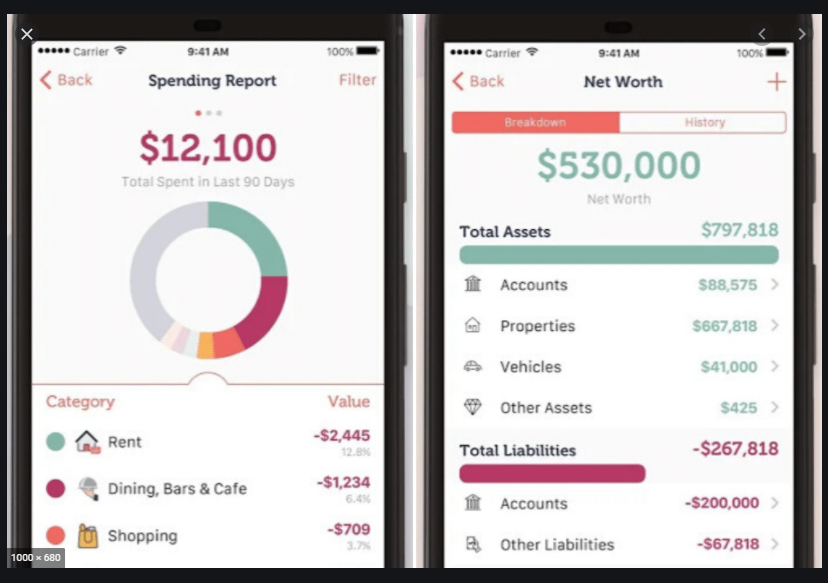

Simple Budgeting Reports you understand

Having simple reports that show you how well you’re following your budget on weekly, monthly and yearly basis is very important. That’s all a part of your journey with your finances.

Having an app that has an in-depth as well as brief overview of your income and expenditures is important in bettering your money situation. They will be able to show you the nitty gritty of your finances as well as a quick view in short. Best of both worlds.

Bank Level Security among Financial Information

Having your financial information safe is number one priority. Well at least it should be. Data encryption is a must as well as two factor authentications.

Two factor authentications are another process added to security where a fingerprint scan or another password is added to help verify and identify as well as prevent cybercriminals from accessing your private financial information.

This is extremely important with the app you choose, having your financial information strictly confidential to you is imperative.

Easy set up time

No one ever has been ecstatic about having to wait hours and hours for a service or a product. So, having an easy and quick set up is very important. Understanding the entire service is key too.

Offering a free trial run is always worth it, so that if you do love it, your information is already ready to go. Also, a rather lengthy on boarding process could also force you to make mistakes which could cause issues down the track using the service. A quick, easy and straight forward onboarding process is the difference between someone using the app for years or not at all.

The best budgeting apps In Australia in 2020 have been recorded to be UBOMI, Money Brilliant, Pocketbook, Spendee, Money tree, Pocket smith and the Wise List app. All these apps have many similarities but what sets them apart from each other are all their differences and differently displayed features.

Let’s take a look at a few –

UBOMI

UBOMI provides easy to use tools to help you make the right decisions with your money goals. We are more than just a budget app, we are a complete money managing platform that assists everyday Australians achieve financial freedom.

Intuitive design. Effortless function. UBOMI puts you in the driver’s seat, set and accomplish your own goals, rid yourself of debt, and see your progress along the way — all with the accompany of us, your financial assistant!

FEATURES:

- Connect all your accounts to see a complete picture

- Understand and categorise your spending in able to change it

- Manage all incoming and outgoings with added support

- Create budgets and track their progress

- Set both short and long term money goals

- Manage your finances

- Have access to financial tips that are guaranteed to assist

- Free Service with upgrades available along the way.

Available through: Google Play stores

Money Brilliant

Money brilliant has your back when it comes to all things budgeting and managing your personal finances. The app is able to connect to a multitude of banks, credit cards, loans superannuation plus more.

Features:

- All transactions will be categorised automatically through an import machine.

- Know your net work

- All your money is in one place

- Personal insights and alerts

Cost: Basic version is Free, $9.90 for more added features per month

Available through: App store and Google Play

Pocketbook

With Pocketbook, instead of having to manually enter your expenses into the app, Pocketbook syncs with your chosen bank account to give you a complete view of your spending.

Pocketbook has described themselves as the personal assistant for your money. Pocketbook is able to categorise your transactions and give you a full breakdown of your spending so you can find the places to save within your budget.

Features:

- Automatic categorisation of the majority of your transactions.

- FAQS in detail for the beginner user

- Security is top level with encryption

Cost: Free

Available through: Apple App and Google Play stores

Spendee

Keep it simple. Have perfect control. Get a quick overview. Use smart budgets.

Features:

- Shared wallets available (house mates, couples etc)

- Categorise spending and with pictures as well as locations

- Easy to understand graphic that tracks your account balance

- Puts all your transactions, from various bank accounts, in one place

Cost: Spendees have not only a free version but a plus and premium too. These come with yearly fees which are confirmed as you go.

Available through: Apple App and Google Play stores

Moneytree

Moneytree encompasses many facets of money management. It combines every branch of finance from bank accounts to digital money, and collects, analyses, and displays your financial data from a wide rang of services as well as institutions.

Money tree also gives you access to all your frequent flyer, loyalty points and MYER one to keep you up to date on how many points you have, when you can use them and alert you when they are about to expire.

Features:

- Links your bank accounts, credit and debit cards, digital money and cash spending

- Analyses every detail of your spending down to the specific time, date and place

- Work expenses tracker that can be exported into a spreadsheet

- Colourful and easy to understand graphs that track your financial situation

Cost: Free

Available through: Apple App and Google Play stores

If you liked our “The Best Budgeting Apps to Help Aussies Save Money” and took away some valuable information, check our blog space regularly for more updates on the best budgeting apps in Australia.