Are Finance Apps The New Gym Membership?

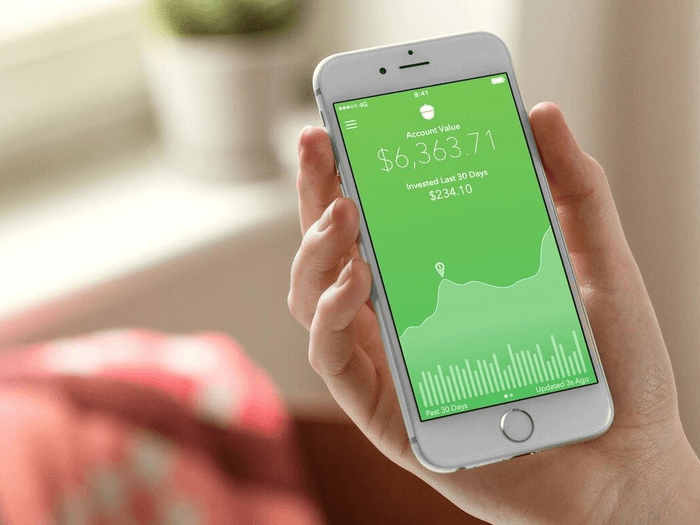

Are finance apps the new gym membership? As more people are looking after their financial wellbeing, we are downloading finance apps more than ever. But are these apps really helping us complete our financial goals?

To put quite simply, Australian’s over the last decade have been looking for financial answers to make sense of their own personal financial situations. We are in a day and age where if you can do it yourself, you will! Looking after your financial wellbeing has never been so popular.

Why are people using personal finance apps?

- Track every financial move, day to day spending.

- Compare with benchmarks of how much is coming in and out.

- Lack of financial knowledge can put you in a dangerous position.

- Come with a myriad of features that will ease intricate financial tasks.

- Guarantee financial transparency and therefore feel more confident with finances.

How can we relate a gym membership with a financial app?

Why do people sign up and buy a gym membership?

- To improve overall health

- Lose weight.

- Gain weight.

- Improve energy levels.

- Improve mental clarity.

- Meet likeminded people with similar goals.

These all can be related to investing in a budgeting/ financial app.

- To improve overall financial status.

- Lose debt or minimise as much as possible.

- Want more structure.

- Improve mental clarity.

- Be connected to like-minded people who are able to keep you accountable.

Regardless of anything an online finance dashboard makes your overall financial health more apparent. Allowing all your accounts to be in the one simple place.

How to get more from finance apps?

Like a gym membership, the biggest challenge you face is maintaining motivation on your own and being accountable. Very similar to a personal trainer, their job is to assist you in putting together a workout plan and diet schedule that’s going to be disciplined yet achievable. It is important to identify your financial goals you are working towards and what steps you are going to take to complete them.

If you do use a budgeting or finance app make sure that this app allows you to track the process of your goals ensuring that you are able to speak to someone who is qualified to keep you accountable throughout the course of your journey.

Like all things, especially unused gym memberships, make sure that you have a financial professional / mentor who will keep you motivated and get you to where you need to be financially.

What to look for when choosing among finance / budgeting apps?

Firstly, is it available to you on your chosen device? Making sure you can access the app via either the App store (IOS) or Google Play (Android).

Secondly, it offers a free trial or even a free version. Often the apps that have a free version are the best as they give you a good insight into what they are about before paying for a premium version with added features.

You will also want the chosen app to sync to your bank account. If the app can categorise your transactions this is a huge bonus as manually doing it to recognise trends among your finances can become very tedious.

Lastly too, looking for an app that has a transparent and clear security system, at the end of the day these apps are dealing with your finances, having the peace of mind most definitely is imperative.

If you liked our “Are Finance Apps The New Gym Membership?” and took away some valuable information, check our blog space regularly for more updates on the best apps for spending tracking and apps for finances in Australia.